How FinBee works?

FinBee is an online p2p lending and investing platform, our main goal is to find solvent borrowers and to provide solid returns to investors.

Lending and borrowing steps

- Individuals who want to borrow money submit an application where they indicate desirable amount of money and credit term.

- FinBee team verifies credit rating of every individual applying for a loan in accordance with the objective criteria and makes the decision whether to approve it.

- Lenders review existing applications and choose which ones to invest in.

- When loan in financed, borrower confirms contract terms and conditions.

- Each borrower signs a contract in a written form. The borrower provides a valid identity document at the moment of signing. The purpose of this face-to-face process is to ensure a true identity and to avoid fraudulence.

- After the application is fully funded, borrowers repay the loan on an annuity monthly basis. Returned money is automatically transferred to lenders’ FinBee account.

- Lenders can withdraw the money or to reinvest into new loans.

All financial transactions between investors and borrowers are performed through Clients’ Money Account (CMA) in one of the banks in the Czech republic – Fio banka.

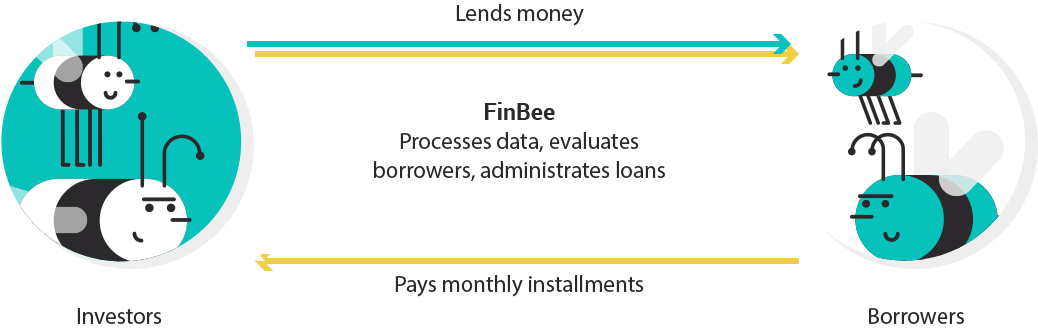

HOW DOES P2P PLATFORM WORK?

ABOUT P2P LENDING

In peer-to-peer (p2p) lending platform investors lend money to other individuals. Through this lending framework, consumer lending becomes innovative, more transparent and more profitable for both parties involved: borrowers and lenders. Lenders mitigate the individual risk by choosing which borrowers to lend to, and total risk is mitigated by diversifying investments among different borrowers.

P2P lending model was developed in the United Kingdom more than 10 years ago and today it is popular all over the world. The largest online platforms are created in the USA and UK. The latter’s government invests through the biggest national P2P lending company.

Growing popularity of p2p lending shows that investors have valued the opportunity to earn more money by taking higher risk but leaving no profit for banks or other financial institutions.